Assemble Housing

Designing a new service offering to fulfill a customer promise

We worked with Assemble, a community and sustainability-focused property development and management company, to design a new financial coaching service.

Outcomes

-

Service Design for a brand-new, bespoke financial coaching service

-

A framework detailing the content, format and timing of learning modules appropriate to different phases of the resident journey

-

An implementation strategy including timelines and recommendations

-

An evaluation framework for testing the pilot program

-

A detailed position description for the new role of Community Financial Coach, including responsibilities, experience and competencies

Services

- Service design

- Community engagement

Sectors

Designing an entirely new service model from scratch

Assemble is a property development and management company focused on delivering projects where good design, community and sustainability go hand in hand. Assemble offers a new pathway to homeownership – bridging the gap between renting and owning your home

Assemble’s promise to customers included complimentary financial coaching to help them save towards a deposit on their own home.

However, they did not know what shape this financial coaching should take. It was important to them that it be genuinely helpful to their customers, so they engaged Paper Giant to find out what their customers wanted, what they would actually engage with, and what would help them on their pathway to homeownership.

Human-centred and evidence-informed

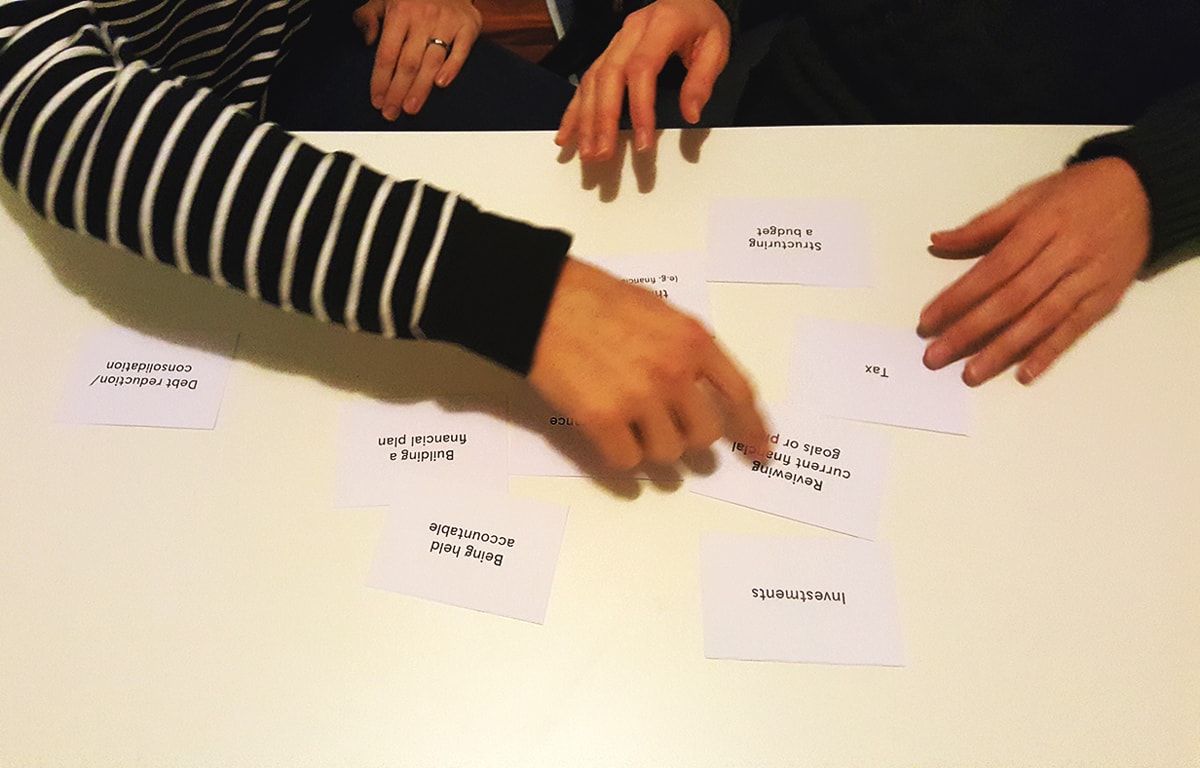

Paper Giant involved residents (end users) and subject matter experts (especially financial coaches) throughout the process. We interviewed fifteen future residents of one of Assemble’s first community, two financial coaches and one expert stakeholder. The proposed model that we developed was tested with three financial coaches and five expert stakeholders.

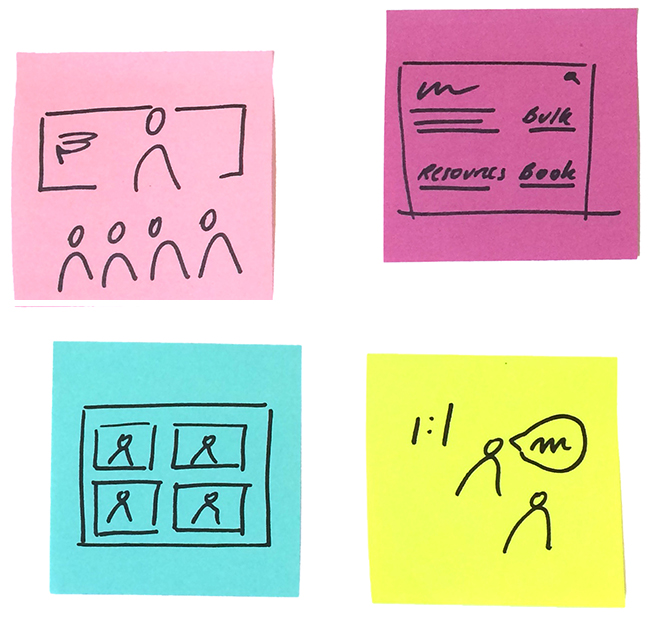

The model consists of seven learning modules and includes a variety of tools, sessions and guidance. Residents can select and apply those that work for them, when and how they want. The service shapes itself around residents, rather than forcing residents to fit the service.

Recognising the emotional element

The subject of money and finances can often have hidden emotional weight and complexity, and the purchase of something as expensive as a home, even more so. Each of our proposed learning modules is accompanied by psychological, emotional and behavioural insights into Assemble customers.

The implementation strategy includes recommendations for how to best space out training so as not to overwhelm customers with too much information at once.

A collection of spreads from the final Assemble Report document

An evaluation framework to enable continuous improvement

Paper Giant provided recommendations for effectively evaluating the coaching service to make sure it is engaging customers and helping them reach their goals. This includes performance targets, review dates, and key indicators to track. The coaching service will be responsive to feedback and stay relevant to customers throughout the long duration of their relationship with Assemble.

Assemble employees are now using the framework as a ‘playbook’ to know how and when to engage with their residents who are saving for a deposit and building financial wellbeing while enjoying life in their new home.