Market research: understanding the landscape before you move

Market research is the systematic study of customers, competitors, and untapped opportunities. We blend quantitative rigour with qualitative depth to give organisations a clear picture of the demand landscape, competitive dynamics, and segments that matter most.

Understanding the terrain before you commit

Market research is how you see the landscape clearly before making strategic bets. It's the systematic study of customers, competitors, and the forces shaping demand — designed to surface not just what's happening now, but where the real opportunities sit.

When we conduct market research, we're mapping the operating environment from multiple angles:

- Customer demand — who needs what, how intensely, and what's currently underserved

- Competitive dynamics — where others are strong, where they're vulnerable, and what gaps remain open

- Market structure — the segments, channels, and economic patterns that determine where value flows

The goal isn't data for its own sake. It's a decision-ready view of where to play, who to serve, and what it takes to win.

How we approach market research

Traditional market research often delivers thick reports that sit on shelves. We combine quantitative analysis — surveys, data modelling, demand sizing — with qualitative depth to produce outputs teams actually use.

Our approach starts with framing the strategic question: what decision does this research need to inform? From there, we design a programme that typically blends:

- Quantitative methods — survey design, conjoint analysis, segmentation modelling, and secondary data analysis

- Qualitative depth — in-depth interviews, contextual observation, and expert conversations that reveal the reasoning behind the numbers

- Synthesis into strategy — segmentation models, competitive audits, demand landscapes, and opportunity maps that connect directly to decisions

What comes out isn't a data dump. It's a strategic picture that product, marketing, and leadership teams can act on — with evidence behind every recommendation.

From product launches to policy design

We've applied market research across contexts as varied as fintech market entry and national energy policy. The method adapts because the core challenge is universal: understanding the demand landscape well enough to act with confidence.

Whether you're entering a new geography, sizing an emerging market, or designing policy that needs to reflect real-world behaviour, the starting point is the same — rigorous evidence about who needs what, and where the gaps sit.

When TransferWise needed to understand how Australians think about money transfers before launching locally, we mapped the attitudes, behaviours, and competitive landscape that shaped their market entry strategy.

Turning market evidence into strategic choices

The most valuable market research doesn't just describe what's out there — it reveals where the opportunities are and how to reach them. When you understand not just the size of a market but its structure — who the underserved segments are, what drives switching, and where incumbents are weakest — you can make investment decisions with conviction.

We've applied this lens for clients building products, designing services, and shaping policy — turning complex market data into clear strategic frameworks that teams can rally around.

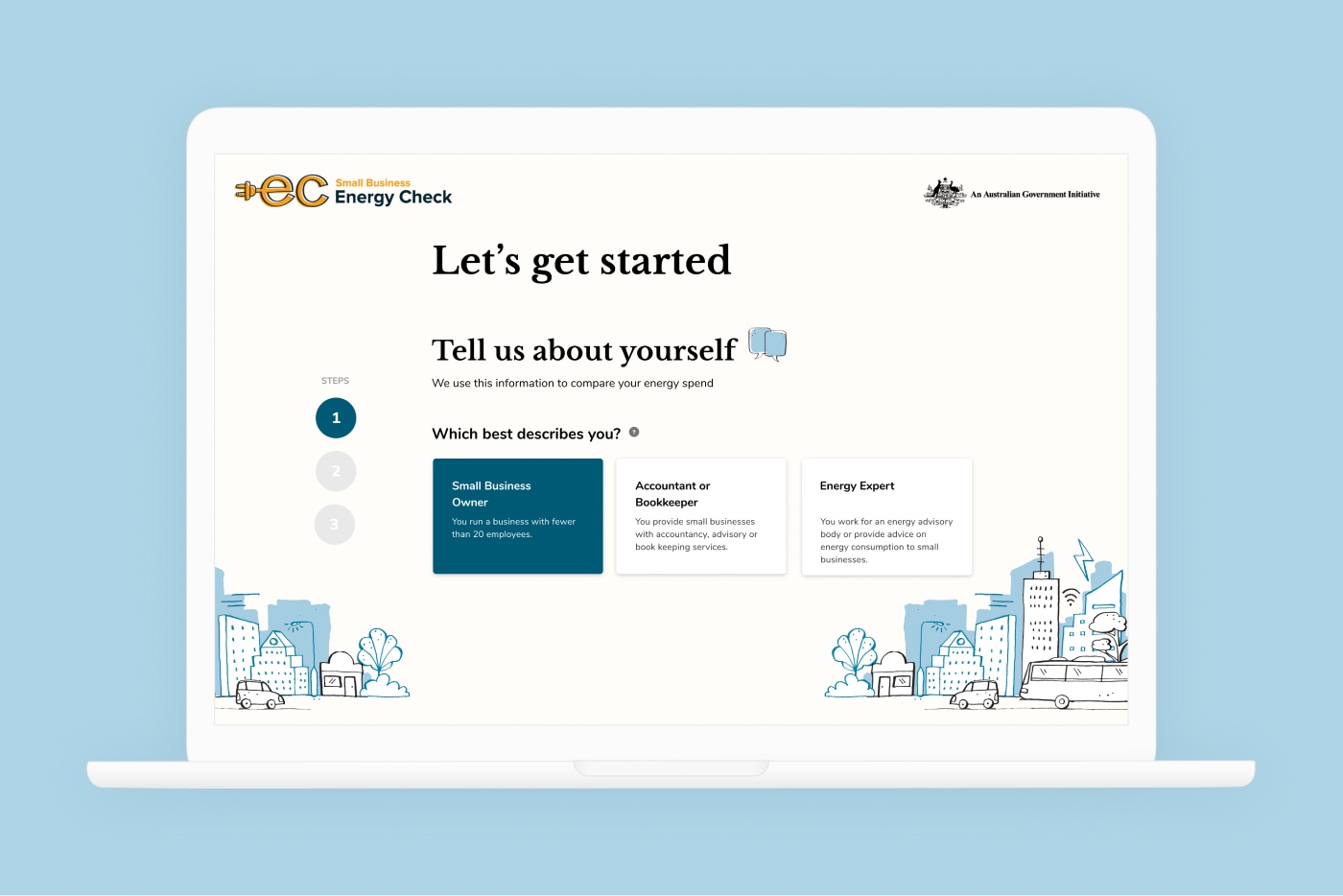

We researched small business owners and their ecosystem to understand how they think about energy spend — then used those insights to design a benchmarking tool that turns complex market data into something businesses can actually use.

Seeing the system, not just the market

The most consequential market research looks beyond customers and competitors to the forces that shape the whole system. Regulatory change, technology shifts, emerging intermediaries — these structural dynamics often determine where value will flow before individual players even make their move.

We bring this systems lens when the stakes are highest: when policy decisions need to reflect market realities, when platform strategies depend on ecosystem dynamics, and when the question isn't just "what do customers want?" but "how is this entire landscape evolving?"

We partnered with AEMO to map the forces shaping energy data innovation across Australia — uncovering the barriers, incentives, and structural dynamics that needed to shift to unlock a more open energy data landscape.

Research that moves organisations forward

Our market research has helped clients enter new markets, design national-scale tools, and reshape industry strategy. When you understand the demand landscape with precision — who's underserved, where the structural gaps sit, and what drives real behaviour — you stop reacting to competitors and start shaping the market on your terms.

From sizing an opportunity to designing the strategy that captures it, we give organisations the evidence they need to commit with confidence.

Ready to understand your market? Let’s map the landscape together.